- What is an ABN?

An ABN, or Australian Business Number, is a unique 11-digit identifier issued by the Australian government to businesses and organizations. It helps streamline business interactions with government agencies and simplifies financial transactions.

- Who needs an ABN?

Businesses and entities that are carrying on an enterprise in Australia generally require an ABN. This includes sole traders, partnerships, companies, trusts, non-profit organizations, and more.

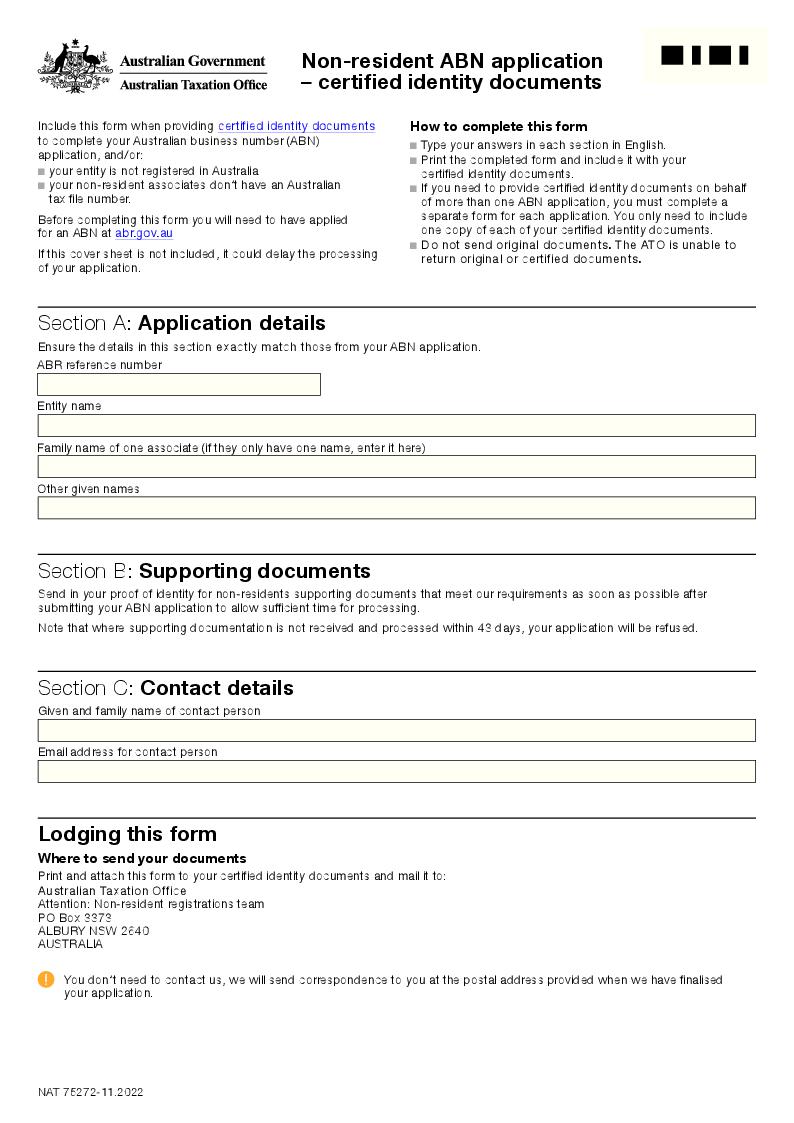

- How do I apply for an ABN?

You can apply for an ABN online through the Australian Business Register or using a quialified special agent.

- What information do I need to provide when applying for an ABN?

The information required may vary based on your business structure, but typically, you’ll need details such as your name, date of birth, physical address, email address, Tax File Number (TFN), and information about associates or partners in your business.

- Can I use my ABN immediately after applying?

In most cases, yes. Once you submit your ABN application online, it should take no more than 24-48 hours for the Australian Taxation Office (ATO) to process your application and provide you with your ABN.

- What if my ABN application is rejected

If your application is unsuccessful, you will receive a refusal number. Within 14 days, you’ll also receive a letter explaining the reasons for the refusal and outlining your options, including your rights to review the decision.

- Do I need to register for GST when I get an ABN?

Not necessarily. Registering for the Goods and Services Tax (GST) is a separate process. If your business has a GST turnover of $75,000 or more, you are generally required to register for GST.

- What are the benefits of having an ABN?

An ABN offers benefits such as credibility, simplified transactions, the ability to claim GST credits, access to government benefits, and more. It also helps you avoid Pay As You Go (PAYG) tax on certain payments.

- How often should I update my ABN details?

It’s important to keep your ABN details up to date. You should update your information whenever there is a change in your business structure, contact information, associates, or any other relevant details.

- Do I need an ABN or ACN?

If you’re operating a business in Australia, having an Australian Business Number (ABN) is a requirement. Additionally, if you’ve registered your business as a company through ASIC, you’ll also receive an Australian Company Number (ACN). ASIC mandates the use of an ACN as a unique identifier for your company’s activities.

- How many digits are in an ACN or ABN?

An ABN consists of 11 digits, uniquely identifying your business, while an ACN comprises 9 digits. A company’s ABN will always include their ACN with a two-digit prefix.

- What is the cost of obtaining an ABN?

Registering for an ABN through the official government body, the Australian Business Register, incurs no fees, whether you apply online or via paper.

- What is the cost of obtaining an ACN?

As of July 1, 2022, the cost for registering a company is $538. This fee is subject to annual increases in line with the Consumer Price Index. For the most up-to-date fees, please consult the ASIC website.

- What are the prerequisites for obtaining an ABN?

To qualify for an ABN, you must be able to demonstrate the presence of a valid business structure.

- Can you use the same ABN for more than one business?

Certainly, as a sole trader, it is permissible to employ the same ABN to conduct multiple businesses. However, it is crucial to ensure that these businesses share the same business structure. Sole traders may utilize their personal Tax File Number (TFN) for their business, whereas other business structures, such as companies, are mandated to have a distinct TFN dedicated to their business operations.

- Do you need an ACN if you are a sole trader?

No, if you are a sole trader, your requirement is solely to register for an ABN. An Australian Company Number (ACN) is obligatory only for businesses seeking company registration, which is a distinct process through ASIC.

It’s important to note that ABN also comes with responsibilities, including the need to keep your ABN details up to date, meet tax obligations, and comply with relevant laws and regulations. It’s advisable to consult with a tax professional or the Australian Taxation Office (ATO) to ensure you understand your obligations and maximize the advantages of having an ABN for your specific business situation.