What is an Australian Business Number (ABN)?

What is an Australian Business Number (ABN) and advantages

An Australian Business Number (ABN) is an 11-digit identifier unique to your business, issued by the Australian Taxation Office (ATO). It plays a crucial role in distinguishing your business in the eyes of the government and the wider community. An ABN can be used for various purposes, including:

Establishing your business identity in transactions and when issuing invoices

Exempting your income from Pay As You Go (PAYG) tax.

Claiming Goods and Services Tax (GST) credits.

Qualifying for energy grants credits.

Facilitating the registration of an Australian domain name.

Advantages of Having an ABN

Who Should Apply for an Australian Business Number?

If you are conducting any business activities in Australia, it is essential to apply for an Australian Business Number. The following entities typically require an ABN:

Sole Traders and Self-Employed Individuals: If you operate a business as a sole trader, meaning you’re self-employed and not in a partnership or company structure, you should get an ABN. This includes freelancers, consultants, and contractors.

Partnerships: If you are in a partnership, the partnership entity should have its ABN.

Companies: Registered companies automatically receive an Australian Company Number (ACN). However, if the company is going to operate a business, it will also need an ABN.

Trusts: Trusts that operate a business in Australia generally require an ABN. The trustee of the trust can apply for the ABN.

Non-Profit Organizations: Non-profit organizations (NPOs) that operate a business or trade in Australia should obtain an ABN.

Entities Dealing with the Australian Tax Office (ATO): If you need to interact with the Australian Tax Office for tax-related matters, such as claiming GST credits, you will typically need an ABN.

Entities Selling Goods and Services: If you plan to sell goods or services and want to avoid customers withholding tax (PAYG), having an ABN is essential.

Claiming Energy Grants Credits: If you are eligible for energy grants credits, you need an ABN to claim them.

It’s important to note that having an ABN doesn’t automatically mean you need to register for GST (Goods and Services Tax). The GST registration is a separate process, and you may need to register for it depending on your business turnover.

Before applying for an ABN, it’s advisable to consult with a tax professional to ensure that you meet the requirements and understand your specific tax obligations. Additionally, the requirements and regulations may change over time, so it’s essential to stay informed about the latest guidelines from the ATO.

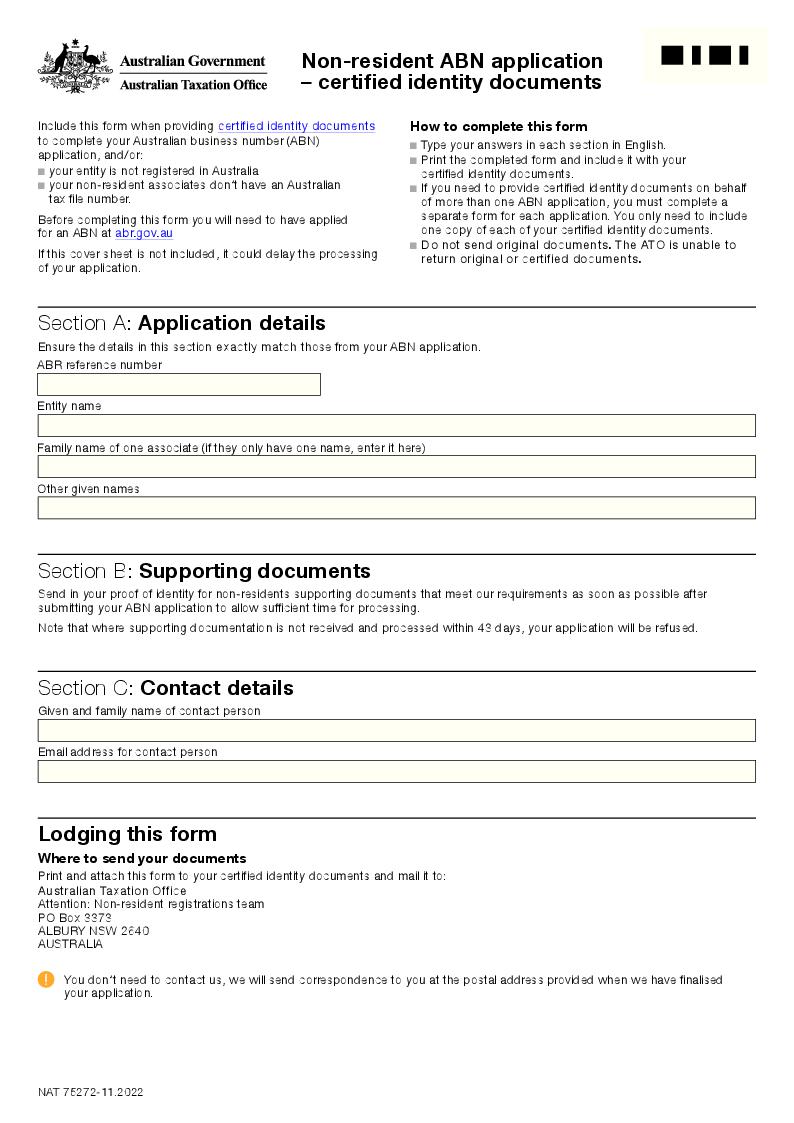

Required documents for your ABN application

Prior to submitting your ABN application, it’s essential to determine the appropriate business structure. Remember there are commonly 4 types of business structures:

- Sole trader

- Partnership

- Company

- Trust

Requirements:

To complete your ABN application, you’ll need to provide the following information, depending on your specific circumstances:

Your tax file number (TFN) and the TFNs of any associates, such as partners, directors, and trustees. You can check all the information related with TFN here

If you engage a registered agent, you’ll need their registered agent number (tax or BAS agent).

If you’re utilizing the services of a professional adviser, you can provide their license number, such as an Australian Financial Services license (AFS license).

- Any previously held ABN.

- For companies and registrable organizations, you’ll require the Australian company number (ACN) or Australian registered body number (ARBN), obtainable through the Australian Securities and Investments Commission (ASIC).

- Specify the date when your ABN is needed. This should be the date you anticipate commencing business activities, such as purchasing stock. Note that this date cannot be more than six months in the future at the time of your application.

- Provide the entity’s legal name, which appears on all official documents or legal papers.

- Include authorized contacts, which may be a registered tax or BAS agent if they have authorization to make changes or update information on behalf of the entity.

- Furnish associates’ details, keeping in mind that associate requirements vary depending on the entity type.

- Supply business contact details, including an address, postal address, email address, and phone number. Ensure that your email address adheres to certain requirements, such as a length between 5 – 200 characters and not starting with ‘support@,’ ‘Sales@,’ or ‘info@.’

- Specify your main business activity, which is typically the primary source of income for your enterprise (e.g., agriculture, construction, investment, manufacturing). Note that self-managed super funds may not be considered as carrying on a business and may not have a main business activity.

- Provide physical locations for all premises operated by your enterprise as part of your business locations. However, if disclosing this information poses a risk to the safety of individuals, for example, in the case of a women’s refuge, an exception may apply.

How to apply for a ABN

You can register for an ABN online at the official government site www.abr.gov.au or, alternatively you can have your BAS Agent or Tax Agent apply for the ABN on your behalf.

The specific information required depends on the structure of your business registration, whether it’s a sole trader, partnership, company, or trust. Generally, you will need the names, dates of birth, physical addresses, email addresses, and TFNs of the individuals associated with the business.

If you find yourself uncertain about the advantages and disadvantages of the different available business structures or if you’re unsure about how to complete the form, it is advisable to engage in a discussion with experienced and professional accountants. They can provide you with the most suitable guidance for your business.

If your application is successful you will receive your ABN immediately. If you receive a reference number it may mean the government need to check some details in your application or more information is needed.

In the event that your application is not approved, you will be provided with a refusal number. Additionally, within a span of 14 days, you will receive a letter officially stating the rejection of your application, outlining the reasons for the refusal, and presenting the available options, including your rights to review the decision.

Benefits of the ABN

The benefits of having an ABN extend beyond just identification. Here are some key advantages:

Identification and Credibility: An ABN serves as a unique identifier for your business. It enhances your credibility and professionalism when dealing with other businesses, customers, and government agencies.

Avoiding Pay As You Go (PAYG) Tax: With an ABN, you can receive payments from clients or customers without them withholding Pay As You Go (PAYG) tax. This simplifies cash flow and financial management for your business.

Claiming Goods and Services Tax (GST) Credits: If your business is registered for GST, having an ABN allows you to claim GST credits on eligible business expenses, reducing your overall GST liability.

- Access to Government Benefits and Grants: Many government grants, subsidies, and programs require applicants to have an ABN. Having one can make your business eligible for various financial incentives and support.

- Streamlined Business Transactions: An ABN makes it easier to engage in business transactions, such as ordering products and services, invoicing clients, and participating in business-to-business (B2B) commerce.

- Professional Image: Displaying your ABN on invoices, websites, and other business documents enhances your professional image and helps build trust with customers and partners.

Legal Requirements: Some business activities, especially those involving the provision of certain services, legally require an ABN. Failure to have one when required can lead to penalties.

Tax Deductions: Certain business expenses are tax-deductible, and having an ABN is often a prerequisite for claiming these deductions.

Business Name Registration: If you want to register a business name in Australia, you generally need an ABN. A registered business name is different from your company or individual name and helps protect your brand identity.

Simplified Reporting: An ABN can streamline reporting requirements for businesses, making it easier to fulfill tax obligations and comply with government regulations.

International Business: If your business engages in international trade, having an ABN can facilitate dealings with overseas partners, as it provides a standardized identifier recognized globally.

It’s important to note that while an ABN offers numerous benefits, it also comes with responsibilities, including the need to keep your ABN details up to date, meet tax obligations, and comply with relevant laws and regulations. It’s advisable to consult with a tax professional or the Australian Taxation Office (ATO) to ensure you understand your obligations and maximize the advantages of having an ABN for your specific business situation.